I’ve had the opportunity to explore and evaluate a multitude of forex brokers. Among them, IC Markets stands out as one of the best forex brokers, particularly in Nigeria. This Australian-based broker has made a significant impact on the global forex market, and it’s not hard to see why. With its exceptional ECN (Electronic Communication Network) model, IC Markets offers a trading environment that is hard to match.

One of the key questions you might have is, “Can I use IC Markets in Nigeria?” The answer is a resounding yes. IC Markets is not only accessible to Nigerian traders, but it’s also a safe, regulated, and legitimate platform for forex trading. Let’s delve into the details.

Can I Use IC Markets in Nigeria?

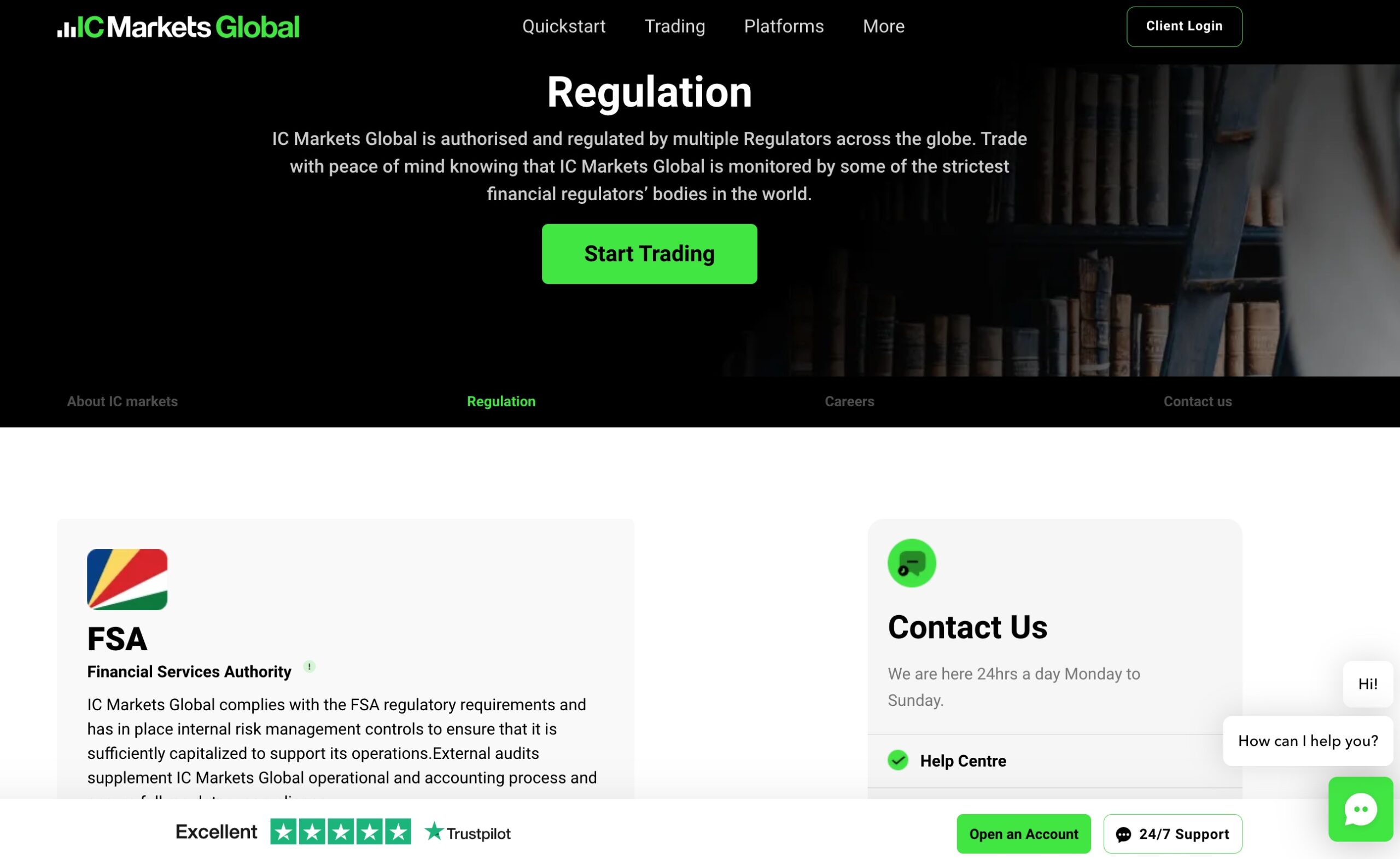

Yes, you can use IC Markets in Nigeria. It’s a reputable broker with a wide range of trading options and a user-friendly platform. The broker is regulated by several financial authorities worldwide, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority (FSA), and the Securities Commission Bahamas (SCB). Nigerian traders will be onboarded through IC Markets’ Seychelles-based entity, regulated by the Financial Services Authority of the Seychelles.

To open an account with IC Markets in Nigeria, you’ll need to provide personal information and documentation to comply with anti-money laundering policies. This includes a government-issued photo ID and proof of address. The documents must be clear and visible, with all relevant details such as name, signature, expiry date, and date of birth easily readable.

When it comes to funding your IC Markets account in Nigeria, you have a variety of options to choose from. Here’s a breakdown of the best methods available to you:

- Credit and Debit Cards: Using credit and debit cards is one of the most straightforward and fastest ways to fund your account. Transactions are usually processed instantly, which means you can start trading almost immediately after you deposit.

- Electronic Wallets: Electronic wallets such as PayPal, Neteller, and Skrill are also popular options. They offer the convenience of quick deposits, similar to credit and debit cards.

- Bank Wire Transfer: For larger amounts, a bank wire transfer might be the most suitable option. Although it can take 2-5 business days for the funds to be credited to your account, this method is often preferred for its reliability and the ability to transfer substantial sums.

Remember to use payment methods that are in your name to comply with anti-money laundering regulations.

Why Choose IC Markets Global in Nigeria

IC Markets Global is a well-regulated CFD provider that offers a host of benefits to traders, making it an attractive choice for those in Nigeria.

Here are some of the top reasons why you should choose IC Markets in Nigeria:

- Competitive Trading Conditions: IC Markets Global offers some of the best trading conditions in the industry. They provide access to a wide range of markets, including 60 different currency pairs and 4 metals across their three trading platforms. Their average EUR/USD spread is as low as 0.1 pips, with a small commission of $3.50 per lot payable per side. This low pricing, combined with unrivaled execution speeds, makes IC Markets Global a preferred choice for day traders, scalpers, and those using Expert Advisors.

- High Leverage: IC Markets Global offers leverage up to 1:500, opening the path to the forex market for retail traders. Using leverage means only a small initial outlay (margin) is required.

- Wide Range of Tradable Assets: IC Markets Global offers a broad range of tradable assets, including bonds, commodities, cryptocurrencies, stock CFDs, forex, futures, and indices. This diversity allows you to diversify your portfolio and find opportunities across different markets.

- Excellent Reputation and Regulation: IC Markets is regulated by some top-tier authorities, including the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Supervisory Authority (FSA), and the Cyprus Securities and Exchange Commission (CySEC). This top-tier regulation significantly enhances the safety of the broker, providing traders with peace of mind.

- User-Friendly Trading Platforms: IC Markets Global offers the MetaTrader 4, MetaTrader 5, and cTrader platforms, which are preferred by many active day traders. These platforms are known for their user-friendly interfaces, advanced charting tools, and algorithmic trading capabilities.

IC Markets Safety and Regulations in Nigeria

IC Markets is considered one of the best forex brokers in Nigeria due to its status as the best ECN forex broker. Established in 2007, IC Markets has built a strong reputation for offering competitive trading conditions, advanced trading platforms, and excellent customer support.

Safety of IC Markets

IC Markets is committed to providing a safe and secure trading environment. It uses advanced encryption technologies to protect your personal and financial information. Additionally, client funds are held in segregated accounts at top-tier banks, ensuring that your money is safe even if the company faces financial difficulties.

IC Markets takes several measures to ensure the highest levels of safety and security:

- Segregated Accounts – IC Markets keeps client funds in segregated accounts at top-tier banks, ensuring funds are protected in the unlikely event of broker insolvency.

- Negative Balance Protection – IC Markets provides negative balance protection, meaning traders cannot lose more than their account balance. This prevents large unexpected losses.

- Secure Trading Platforms – IC Markets’ trading platforms use sophisticated encryption to ensure secure data transmission and prevent cyber attacks.

- Compliance with Data Protection Laws – IC Markets complies with strict data protection laws and implements robust cybersecurity measures to protect client data.

Regulations of IC Markets

IC Markets is regulated by some of the most respected regulatory bodies in the world. It’s regulated by the Australian Securities and Investments Commission (ASIC), one of the strictest regulatory bodies globally. ASIC regulation ensures that IC Markets adheres to strict standards of transparency and fairness.In addition to ASIC, IC Markets is also regulated by the Seychelles Financial Services Authority (FSA). This dual regulation provides an extra layer of security and trustworthiness.

Legitimacy of IC Markets

IC Markets has been in operation since 2007 and has established itself as a reputable and reliable forex broker. It serves clients from all over the world, including Nigeria. IC Markets’ long-standing operation, global client base, and positive client reviews attest to its legitimacy.

IC Markets in Nigeria

IC Markets accepts traders from Nigeria and offers services tailored to meet their needs. Nigerian traders can enjoy the low spreads, fast execution, and excellent customer service that IC Markets is known for. Furthermore, IC Markets offers multiple deposit and withdrawal options, including bank wire transfer, credit/debit card, and e-wallets like Skrill and Neteller, making it convenient for Nigerian traders.

Why IC Markets is the Best ECN Forex Broker in Nigeria

The best ECN brokers provide a marketplace where traders and liquidity providers can place competing bids against each other. This model allows for greater market depth and more competitive pricing, which is a significant advantage for traders.

IC Markets, as an ECN broker, offers this advantage to its clients. They connect traders directly to a network of banks and other liquidity providers, ensuring the best possible prices. This direct market access eliminates the need for a dealing desk, which means there’s no conflict of interest between the broker and the trader. This transparency is a significant reason why IC Markets is considered one of the best forex brokers.

Liquidity Providers for IC Markets

IC Markets sources its liquidity for ECN accounts from a variety of top-tier financial institutions. These include banks, hedge funds, and dark pool liquidity sources. By connecting traders directly to this network of liquidity providers, IC Markets ensures the best possible prices for its clients.

Here are some of the key liquidity providers for IC Markets:

- Global Banks: IC Markets has partnerships with some of the world’s largest banks, such as HSBC, Goldman Sachs, and Citibank. These banks provide a significant portion of the liquidity in the forex market.

- Hedge Funds: Hedge funds are another major source of liquidity for IC Markets. These funds often have large amounts of capital and can provide substantial liquidity.

- Dark Pool Liquidity Sources: Dark pools are private exchanges where trading activities are not visible to the public. IC Markets also sources liquidity from these dark pools, which can offer more competitive prices.

By sourcing liquidity from these diverse sources, IC Markets can offer tight spreads and fast execution for its ECN accounts. This is one of the reasons why IC Markets is considered one of the best forex brokers, particularly for ECN trading.

IC Markets Account Types

As a forex trader in Nigeria, choosing the right account type is as crucial as selecting the right broker. IC Markets, one of the best forex brokers in Nigeria, offers a variety of account types to cater to the diverse needs of traders. Let’s delve into the details of these account types, including the Islamic account.

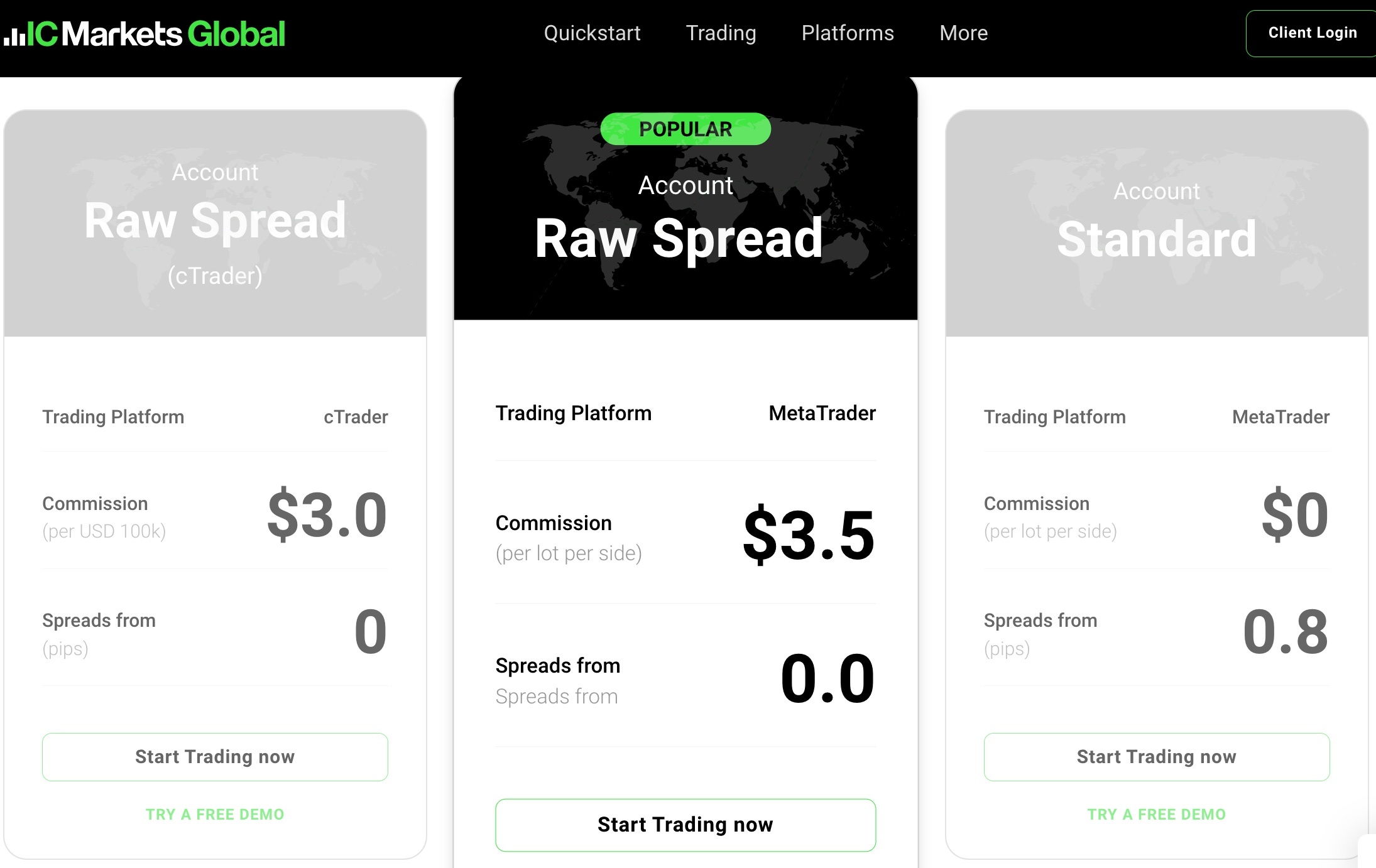

Standard Account

The Standard Account is the most common account type offered by IC Markets. It’s designed for both beginner and experienced traders. Here’s what you can expect:

- Spreads: The Standard Account offers spreads from 1.0 pips, with no commission on trades.

- Trading Platforms: You can use this account type on MetaTrader 4, MetaTrader 5, and cTrader platforms.

- Instruments: The Standard Account gives you access to 64 currency pairs, as well as CFDs on indices, commodities, bonds, and cryptocurrencies.

Raw Spread Account

The Raw Spread Account is designed for more experienced traders and scalpers who prefer a low spread environment. Here’s what it offers:

- Spreads: The Raw Spread Account offers spreads from 0.0 pips, with a commission of $3.50 per lot per side.

- Trading Platforms: This account type is available on MetaTrader 4 and MetaTrader 5 platforms.

- Instruments: Like the Standard Account, the Raw Spread Account gives you access to 64 currency pairs and various CFDs.

cTrader Raw Account

The cTrader Raw Account is specifically designed for use with the cTrader platform. It’s ideal for traders who prefer the features of cTrader. Here’s what you get:

- Spreads: The cTrader Raw Account offers spreads from 0.0 pips, with a commission of $3.00 per 100k traded.

- Trading Platform: As the name suggests, this account type is exclusively available on the cTrader platform.

- Instruments: The cTrader Raw Account gives you access to 64 currency pairs and various CFDs.

Islamic Account

IC Markets also offers an Islamic Account, also known as a swap-free account. This account type is designed for traders who cannot earn or pay interest due to their religious beliefs. Here’s what the Islamic Account offers:

- Spreads: The Islamic Account offers the same spreads as the Standard and Raw Spread accounts, depending on which one you choose.

- Swap-Free: The Islamic Account is free from swap or rollover charges on overnight positions, in line with the Islamic Sharia principle of no interest (Riba).

- Trading Platforms: The Islamic Account is available on all IC Markets’ trading platforms.

- Instruments: The Islamic Account gives you access to all the trading instruments available on IC Markets.

What’s the Minimum Deposit for IC Markets in Nigeria

IC Markets has set a very accessible entry point for traders by keeping its minimum deposit requirement relatively low. The minimum deposit to open a live trading account with IC Markets is $200. This applies to all three types of accounts: Standard, Raw Spread, and cTrader Raw.

In the context of Nigeria, where forex trading is becoming increasingly popular, the $200 minimum deposit requirement of IC Markets is quite reasonable. It’s affordable enough for most traders to get started, yet it’s also substantial enough to allow for proper risk management when trading.

A minimum deposit of $200 helps to ensure that traders are serious about their trading activities and understand the risks involved.

IC Markets Trading Platforms

IC Markets offers a variety of trading platforms to cater to the diverse needs of traders. These platforms are designed to provide traders with a seamless and efficient trading experience. Here’s a detailed look at the trading platforms offered by IC Markets:

MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms in the forex industry. It’s known for its user-friendly interface, advanced charting capabilities, and a wide range of technical indicators. IC Markets’ MT4 platform offers:

- Market Watch Window

- Navigator Window

- Multiple order types

- 30 pre-installed technical indicators

- 24 graphical objects

- Nine timeframes

MetaTrader 5 (MT5)

MetaTrader 5 is the successor to MT4 and offers additional features and tools. It’s designed to improve the trading experience with enhanced charting and more timeframes. IC Markets’ MT5 platform offers:

- Depth of Market (DOM)

- Built-in Economic Calendar

- 38 pre-installed technical indicators

- 44 graphical objects

- 21 timeframes

- Six types of pending orders

cTrader

cTrader is a powerful trading platform designed for ECN trading. It offers advanced order capabilities and a user-friendly interface. IC Markets’ cTrader platform offers:

- Level II Pricing

- Detachable charts

- Automated trading via cAlgo

- 54 technical indicators

- Advanced order protection

- Detailed performance analysis

Among the platforms offered by IC Markets, I would recommend MetaTrader 4 (MT4) for a beginner trader. Here’s why:

Why MetaTrader 4 (MT4)?

- User-Friendly Interface: MT4 is known for its intuitive and user-friendly interface, which is ideal for beginners. It’s easy to navigate and allows you to manage your trades efficiently.

- Advanced Charting Capabilities: MT4 offers advanced charting capabilities that can help you analyze the forex market. Even as a beginner, you can learn to use these tools to make informed trading decisions.

- Wide Range of Technical Indicators: MT4 comes with 30 pre-installed technical indicators that can help you identify trends and signals in the market. These indicators can be a valuable resource as you learn to interpret market movements.

- Automated Trading: MT4 supports automated trading through Expert Advisors (EAs). As a beginner, you can use EAs to automate your trading strategy and learn from their trading decisions.

- Community Support: MT4 has a large and active community of users. This means you can find plenty of resources, tutorials, and forums online to help you understand the platform and improve your trading skills.

- Micro Lots Trading: With less than $1000 of trading capital, trading in smaller lot sizes is a prudent strategy. MT4 supports micro-lots (0.01 lots), allowing you to manage your risk effectively.

MT4’s user-friendly interface, advanced charting capabilities, and support for micro-lots make it an excellent choice for a beginner forex trader with a small trading capital. But remember, the key to successful trading is not just the platform but also a solid trading strategy, good risk management, and continuous learning.

IC Markets Education and Research

In the world of forex trading, education and research are key to making informed trading decisions. IC Markets, one of the best forex brokers, understands this and offers a comprehensive suite of educational and research resources. Let’s delve into the details of these offerings.

IC Markets Education Offering

IC Markets provides a wide range of educational resources that cater to both beginner and experienced traders. Here’s what you can expect:

- Trading Guides: IC Markets offers a series of detailed trading guides that cover a wide range of topics, from the basics of forex trading to advanced trading strategies. These guides are designed to help you understand the intricacies of the forex market and develop effective trading strategies.

- Webinars: IC Markets regularly hosts webinars led by industry experts. These webinars cover a variety of topics and provide valuable insights into market trends and trading techniques.

- Video Tutorials: IC Markets provides a series of video tutorials that cover various aspects of forex trading. These videos are a great way to learn at your own pace and revisit topics whenever you need.

IC Markets Research Offering

In addition to its educational resources, IC Markets also provides a robust suite of research tools:

- Market Analysis: IC Markets provides daily market analysis articles that cover major market movements and events. These articles can help you stay updated on market trends and make informed trading decisions.

- Economic Calendar: IC Markets offers an economic calendar that lists all the important economic events and indicators from around the world. This tool can be invaluable for planning your trading around key economic events.

- Trading Central: IC Markets provides access to Trading Central, a leading provider of independent technical analysis. Trading Central offers market insights and trading ideas, helping you identify potential trading opportunities.

IC Markets’ market research is both trustworthy and applicable. It provides valuable insights that can help you understand market trends, identify trading opportunities, and make informed trading decisions.

But as always, remember that successful forex trading involves not just relying on market research, but also developing a solid trading strategy, managing your risks effectively, and continuously learning about the forex market.

IC Markets Pros and Cons for Nigerian Traders

Some of the key pros of IC Markets include:

- Low forex fees: IC Markets offers competitive spreads and low commissions, making it an attractive choice for traders looking to minimize their trading costs.

- Advanced trading platforms: The broker provides cutting-edge trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader, catering to both beginners and experienced traders.

- Fast order execution: IC Markets boasts an average execution speed of under 40ms, ensuring that traders can benefit from quick and efficient trade execution.

- Wide range of tradable instruments: With over 2,100 instruments available for trading, including forex, CFDs, commodities, indices, stocks, and cryptocurrencies, IC Markets offers a diverse selection for traders.

- 24/7 customer support: IC Markets provides responsive and helpful customer support through various channels, including live chat, phone, and email.

However, there are also some cons to consider:

- Limited product selection: IC Markets primarily focuses on forex and CFD trading, which may not be suitable for traders looking to invest in stocks, ETFs, or other asset classes.

- Slow live chat support: The live chat support can sometimes be slow and less helpful than desired.

- No investor protection for non-EU clients: IC Markets does not offer investor protection for clients outside the European Union