Whether you’re a seasoned forex trader looking to diversify your portfolio or a beginner who is eager to get a slice of the lucrative forex market, choosing the right forex trading platform can make a world of difference.

The forex market is teeming with opportunities, boasting a daily global turnover exceeding $6 trillion. But to seize these opportunities, you need the right tools, and that starts with selecting a trading platform that’s not just reliable but also tailor-made to meet your trading needs.

In Nigeria, the forex trading scene has been growing exponentially, and with it, the number of platforms vying for your attention.

But let’s face it, not all platforms are created equal. Some excel in offering low spreads, while others stand out for their user-friendly interfaces or range of available assets.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

So, how do you sift through the noise and find a platform that checks all your boxes?

That’s where this article comes in. We’ve done the heavy lifting for you, meticulously evaluating various forex trading platforms based on key features like leverage, spreads, fees, customer service, and user experience.

What’s more, we’ve consulted expert reviews, analyzed user testimonials, and poured through countless statistics to bring you an in-depth comparison that you won’t find anywhere else.

Show Details

Here’s a list of the top 10 best forex trading platforms in Nigeria:

- LiteFinance ✅

- Exness ✅

- HF Markets ✅

- XM Forex

- FBS

- IC Markets

- IQ Option

- JustMarkets

- OctaFX

- AvaTrade

| 💰 Min Deposit | $50 / 20717 NGN |

| 📗 Regulations | CySEC |

| 💳 Trading Fees | From 0.8 pips |

| ⚖️ Max Leverage | 1000:1 |

| 💻 Platforms | MT4, MT5, LiteFinance App |

| 👑 Crypto Trading | Yes |

| ☪️ Islamic Accounts | Yes |

When it comes to forex trading in Nigeria, LiteFinance stands as one of the most reliable and efficient platforms available. Originally known as LiteForex, the company underwent a rebranding but has maintained its commitment to offering top-notch trading services.

🇳🇬 One of the key factors that set LiteFinance apart from the online trading platforms in Nigeria is its strong on-ground presence in Nigeria. The company made a strategic move by opening an office in Lagos in 2015, thereby solidifying its commitment to Nigerian traders. This physical presence not only lends an extra layer of trust but also ensures that you have local support readily available should you encounter any issues.

LiteFinance comes equipped with an arsenal of trading platforms to cater to the varied needs of traders. Whether you're a fan of MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, or prefer trading on the go, LiteFinance has you covered.

-

MT4 & MT5: These platforms are often considered the gold standard in forex trading. They offer advanced charting tools, a plethora of indicators, and the flexibility to employ automated trading strategies.

-

cTrader: Known for its intuitive interface and robust functionality, cTrader is perfect for those who are looking for a more modern trading experience.

-

Mobile Trading Apps: LiteFinance has developed its proprietary mobile apps that allow you to trade on the move without missing out on essential features.

LiteFinance Pros and Cons

- Local presence in Nigeria, offering localized support

- Wide range of trading assets and options

- Competitive and transparent fee structure

- User-friendly interface

- Could offer more educational resources for beginners

- Limited options for automated trading

Exness

| 💰 Minimum Deposit | $10 |

| 📱 Accepts Mobile Money | Yes |

| ⚖️ Regulations | CMA, CySEC, FCA |

| 🔥 Maximum Leverage | 2000:1 |

| 💵 Trading Cost | USD 7 per lot |

| 🖥️ Trading Platforms | MT4, MT5 |

Credibility is a significant factor when choosing a forex broker, and Exness shines in this aspect. The broker is fully compliant with industry standards, and backed by multiple regulations and authorizations.

While it doesn’t hold local licenses in Nigeria, forex traders in the country are registered under Exness regulation by FSA Seychelles as Exness (SC) Ltd. This ensures that you’re trading with a platform that’s considered low-risk, trustworthy, and safe.

🧰 One of Exness’s standout features is its array of trading accounts tailored to meet the diverse needs of forex traders in Nigeria. Whether you’re a newbie or an experienced trader, you’ll find an account type that suits your trading style, each with its own minimum deposit requirement. This customization makes Exness an ideal choice for traders of all levels.

Exness knows that traders are as diverse as the markets they trade in, and that's why they offer a robust range of platforms tailored to meet different needs. Here's a quick rundown of the forex trading platforms offered by Exness:

- Exness Trade App: Available for iOS and Android, this trader-centric app allows instant trade execution and management. From one-click trading to setting your take-profits and stop-losses, it’s all at your fingertips.

- Exness MetaTrader 4 (MT4): If you swear by MetaTrader 4, Exness has got you covered. Enjoy trading CFDs across more than 200 instruments, from major to exotic currency pairs and even metals like gold and silver. MT4 is the world’s leading forex trading platform for a reason, and now it’s available through Exness for your trading excellence.

- Exness Terminal: If you don’t want to download anything, you can access the market instantly through Exness Terminal. This browser-based platform is rich in features, sporting over 50 drawing tools and 100 indicators.

- Exness MetaTrader 5 (MT5): For those who want to stay ahead of the curve, Exness also offers MetaTrader 5. Similar to MT4 but with added features like 21 timeframes and enhanced analytical tools, MT5 offers another level of trading flexibility

Whether you’re trading currencies, crypto, or energies, Exness has an online trading platform that fits your needs.

- Exness is regulated by reputable financial authorities

- Multiple Trading Platforms

- Low trading fees and narrow spreads

- Excellent 24/7 multi-lingual customer service

- Exness doesn't hold a local license to operate in Nigeria, which may be a concern for some traders.

- Limited Educational Resources

- No Local Office

HF Markets

| 💰 Min Deposit | $5 |

| 📗 Regulations | ASIC, CySEC, |

| 💳 Trading Fees | From 0.8 pips |

| ⚖️ Max Leverage | 1000:1 |

| 💻 Platforms | MT4, MT5, HFM App |

| 👑 Crypto Trading | Yes |

| ☪️ Islamic Accounts | Yes |

HF Markets, formerly known as HotForex, consistently ranks among the top forex brokers globally, and for good reason. This multi-asset broker is not only regulated and licensed by multiple top-tier institutions but also boasts an unrivaled reputation for providing superior trading services to both retail and institutional clients.

With local offices in Lagos, Ikeja, and Abuja, HF Markets has a strong foothold in the Nigerian market, making it one of the best forex trading platforms in Nigeria.

While HF Markets specializes in Forex trading, they also offer a diverse range of other assets, including commodities, indices, and cryptocurrencies. This makes the platform a one-stop-shop for traders looking to diversify their portfolio without the need for multiple brokers.

✅ HF Markets offers a proprietary copy trading platform, HFcopy, and provides a decent selection of over 1,000 CFDs and 47 forex pairs.

✅ HF Markets is regulated by multiple top-tier regulators across the globe, including FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

🧭 When it comes to trading platforms, HF Markets offers several options tailored to meet different trading needs. They offer MetaTrader 4 and MetaTrader 5, the industry standards for forex and multi-asset trading.

These platforms are available on various devices, including PC, Mac, and mobile, ensuring you can trade on-the-go. The user interface is clean and intuitive, loaded with advanced charting tools and technical indicators to aid in decision-making.

📱 For traders looking for a more bespoke experience, HF Markets also provides a range of proprietary tools and add-ons. These include one-click trading, auto-trading options, and a customizable dashboard that allows you to keep your most-used tools and charts readily available.

- The improved HFM app now supports trading of 3,500 markets

- Top-tier regulatory licenses ensure transparency and security

- Local offices make customer service more accessible

- Multi-asset platform with a wide range of trading instruments

- Some traders might find the range of proprietary tools overwhelming initially

XM Forex

| 💰 Min Deposit | $5 |

| 📗 Regulations | ASIC, CySEC, |

| 💳 Trading Fees | From 0.8 pips |

| ⚖️ Max Leverage | 1000:1 |

| 💻 Platforms | MT4, MT5, HFM App |

| 👑 Crypto Trading | Yes |

| ☪️ Islamic Accounts | Yes |

XM understands that one size doesn’t fit all, especially in the world of forex trading. Hence, it offers four distinct trading accounts tailored to suit different trading styles and levels of expertise. Remarkably, three of these accounts have an accessible minimum deposit requirement of just 5 USD, making it a perfect choice for newcomers who are wary of investing large sums from the get-go.

Among these accounts, the Ultra Low Account stands out for its exceptional trading conditions. Imagine executing trades on the EUR/USD currency pair with spreads starting at a jaw-dropping 0.6 pips, and doing so without any commission! This is precisely what you can expect from XM’s Ultra Low Account, a feature that is particularly beneficial for traders who prioritize cost-efficiency.

XM isn’t just popular; it’s one of the largest brokers globally in terms of monthly trading volume.

✅ XM Nigeria offers a wide range of educational tools for its clients. These include live education, educational videos, forex webinars, platform tutorials, and forex seminars.

✅ XM is regulated by some of the most respected financial authorities worldwide including Australia’s ASIC, Cyprus’s CySEC, and Belize’s FSC.

🧭 XM offers both MetaTrader 4 and MetaTrader 5 platforms, giving traders the flexibility to choose based on their trading needs. These platforms are renowned for their robust technical analysis tools, customizable interfaces, and automated trading options.

📱 For traders who are always on the move, XM offers a robust mobile trading app that retains most of the functionalities found in their desktop platforms. This means you can execute trades, analyze markets, and manage your account right from your smartphone, ensuring that you never miss out on a lucrative trading opportunity.

- The improved HFM app now supports trading of 3,500 markets

- Top-tier regulatory licenses ensure transparency and security

- Local offices make customer service more accessible

- Multi-asset platform with a wide range of trading instruments

- Some traders might find the range of proprietary tools overwhelming initially

XM Forex, which is one of the best trading platforms in Nigeria offers a lot of bonuses to new clients. To begin with, XM Forex offers a 50% deposit bonus up to $500.

What Does This Mean?

It means that for every deposit you make at XM Forex, the broker will give you an additional 50%. If you deposit $400, the broker gives you an additional $200. The bonuses will continue accruing in your account with each subsequent deposit, until you have earned a total of $500 in bonuses.

But the bonuses do not even stop there.

After you’ve hit a total of $500 in bonuses, the broker will continue giving you trading bonuses at a rate of 20% until you’ve hit a total of $4500 in bonuses.

To cut it short, XM Forex will award you with $4500 in total bonuses as long as you keep those deposits coming. Click here to see the terms of the bonus offer.

But that’s not all there is to this forex broker.

XM Forex happens to be one of the best regulated forex brokers in Nigeria. The broker holds licenses from reputable forex regulators including the Financial Conduct Authority of UK, the Cyprus Securities and Exchange Commission (CySec), and the the Australian Securities and Investment Commission.

If you ask anyone with a little bit of knowledge about forex trading, they’ll tell you that forex brokers who are regulated in these 3 jurisdictions are the safest to trade with. XM Forex is therefore incredibly safe. It earns our trust and love, and we recommend you open an account with them if trading bonuses are your kind of thing.

Is XM Forex Safe?

A trading platform can refer to the software used to place and manage trades on the interbank market. Or it can refer to the brokers that facilitate those trades. For the purposes of this article, we are going to use the second definition and analyze the 7 best forex trading platforms in Nigeria.

10 Best Forex Trading Platforms in Nigeria

-

- LiteFinance ✅

-

- Exness ✅

-

- HF Markets ✅

-

- XM Forex

-

- FBS

-

- IC Markets

-

- IQ Option

-

- JustMarkets

-

- OctaFX

-

- AVaTrade

#1 FXTM (ForexTime) – Best Forex Trading Platform in Nigeria

FXTM, also known as ForexTime, is one of the best and most well established forex trading platform in Nigeria. The forex broker has offices in Lagos, Ikeja, and Port Harcourt. Through their offices, you can consult to know what is needed for you before you start trading forex with them.

Does FXTM Work in Nigeria?

FXTM holds bank accounts in the following banks:

-

- Diamond Bank

-

- First Bank Plc

-

- Guaranty Trust Bank

-

- Keystone Bank

-

- Zenith Bank

To make your work easier, you should also consider opening an account with any of the above banks. However, bank transfers are not the only means of funding your FXTM account. FXTM also accepts funding using 3 of the major e-wallet systems, namely:

-

- Skrill

-

- Neteller

-

- PayPal

The other deposit and withdrawal methods available for FXTM clients in Nigeria are debit/credit card transfers.

As you can see, you are not short on deposits and withdrawal methods with this broker.

FXTM Trading Platforms

FXTM supports both MT4 and MT5 trading platforms in addition to a bespoke FXTM trader app that’s available both on Android and iOS.

If you’re a trader that is always on the go, you’ll benefit a lot from downloading the FXTM Trader app into your Smartphone. Using the app, you can open, modify, and close positions on the go. You’ll also be able to deposit/withdraw funds from your FXTM account straight from the app.

If you prefer to trade from once central location with a big computer screen, MT4 or MT5 trading platforms will be what you need, both of which are available for download from the FXTM trader’s dashboard.

Both MT4 and MT5 are trading platforms from the same company. MT5 is the successor to MT4 and has advanced features compared to MT4. Trading on MT5 via FXTM gives you even broader access to financial markets including foreign exchange, commodities, CFDs and indices as well as stocks and futures.

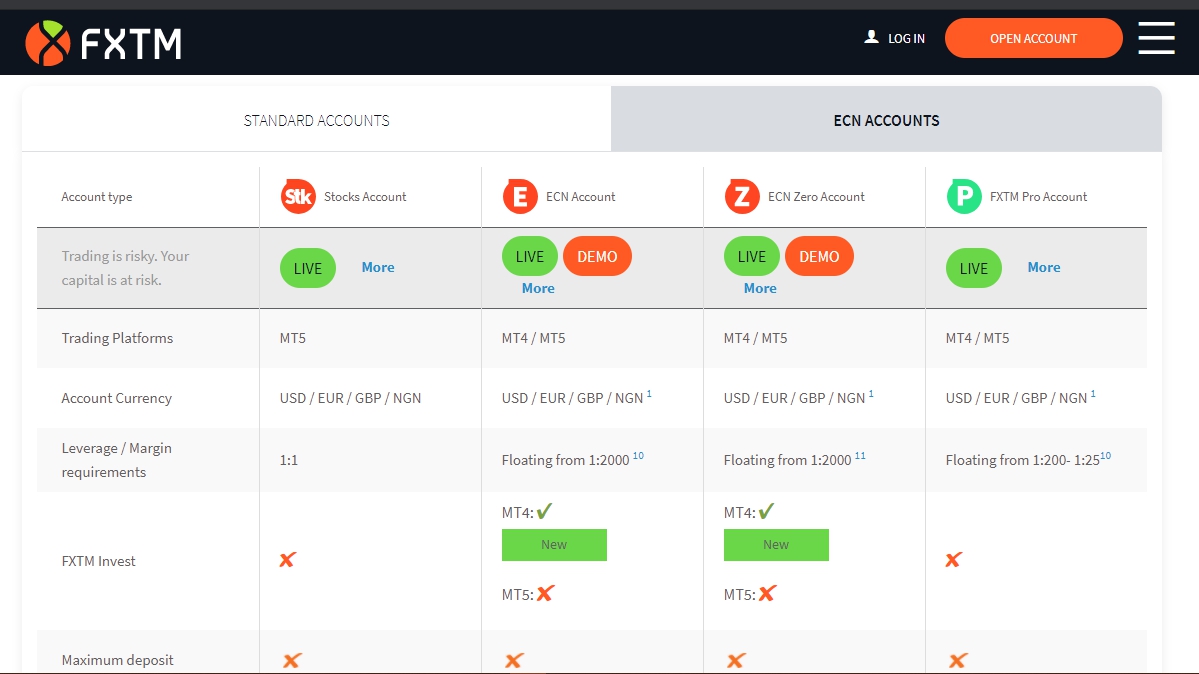

FXTM Trading Accounts

FXTM offers trading accounts in two broad distinctions:

-

- Standard Trading Accounts

-

- ECN Trading accounts

Each account type is further divided into other sub-account types. The Standard Account Types available include, Standard, Cent Account, and Stock CFDs Account. The Stock CFDS account allows you to invest in 100+ US shares and 40+ European shares.

Among the 3 Standard Account Types, we mostly recommend traders to try the Standard and Stock CFDs Account. They both have a minimum deposit of $100, but offer the best trading conditions.

The FXTM Cent Account allows deposits as low as $10, but we do not prefer it, unless you’re opening one to demo your trading strategies.

On the other hand, for the most professional forex traders in Nigeria, we recommend the ECN Account Type. With ECN trading at FXTM, the minimum deposit is $100 for a stock trading, and $200 for the ECN Zero Account.

#2 XM Forex – Best Trading Platform With Good Bonus Offers

Who doesn’t like a good bonus or a promotion? XM Forex, which is the second best trading platform in Nigeria offers a lot of bonuses to new clients. To begin with, XM Forex offers 50% deposit bonus up to $500.

What Does This Mean?

It means that for every deposit you make at XM Forex, the broker will give you an additional 50%. If you deposit $400, the broker gives you an additional $200. The bonuses will continue accruing in your account with each subsequent deposit, until you have earned a total of $500 in bonuses.

But the bonuses do not even stop there.

After you’ve hit a total of $500 in bonuses, the broker will continue giving you trading bonuses at a rate of 20% until you’ve hit a total of $4500 in bonuses.

To cut it short, XM Forex will award you with $4500 in total bonuses as long as you keep those deposits coming. Click here to see the terms of the bonus offer.

But that’s not all there is to this forex broker.

XM Forex happens to be one of the best regulated forex brokers in Nigeria. The broker holds licenses from reputable forex regulators including the Financial Conduct Authority of UK, the Cyprus Securities and Exchange Commission (CySec), and the the Australian Securities and Investment Commission.

If you ask anyone with a little bit of knowledge about forex trading, they’ll tell you that forex brokers who are regulated in these 3 jurisdictions are the safest to trade with. XM Forex is therefore incredibly safe. It earns our trust and love, and we recommend you open an account with them if trading bonuses are your kind of thing.

Is XM Forex Safe?

The only slight downside that XM Forex has over other brokers is that they do not have offices in Nigeria. While this is not an exact turning point, we feel that given the huge number of forex traders in Nigeria, the broker should at least try to establish a local presence.

XM Forex Trading Platforms

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

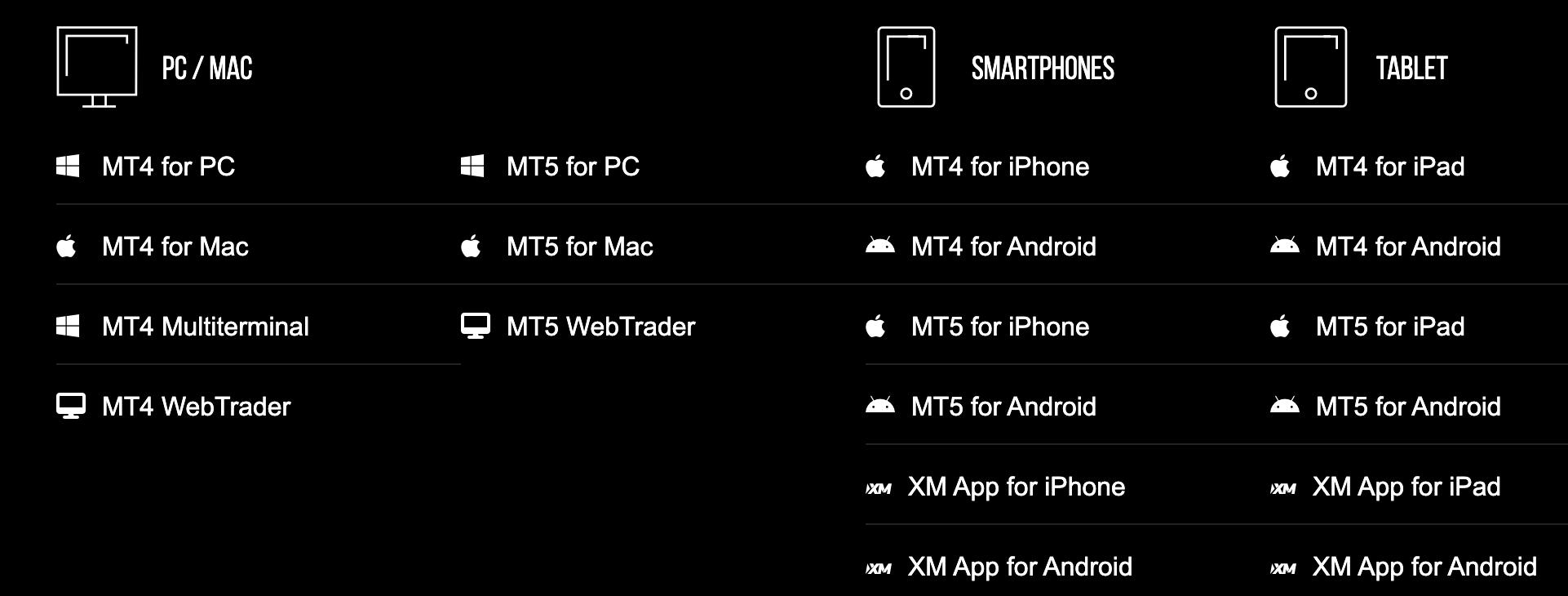

XM Forex supports MT4 and MT5 trading platforms for a variety of devices including PC, MAC, Android, and iOS.

In addition, XM Forex also offers a Multi-terminal MT4 platform. With this platform, you can manage a number of trading accounts all from one terminal. This is a good choice for forex traders who want to manage client accounts.

Trading Software Offered by the Best Forex Brokers in Nigeria

MetaTrader Trading Platform: MetaTrader 4 and 5

MetaTrader is the most widely used Forex trading platform in Nigeria.

Almost all forex brokers with MetaTrader, the ones worth considering at any rate, will make it available for the free use of their clients.

Different versions have been released over the years. Most traders are familiar with MT4. The latest version, MT5, came along early in 2011.

For the most part, the two versions are similar regarding the general design interface, which is only logical considering MetaTrader’s dominant position among Forex trading platforms.

Both versions are computer softwares and the creator (Metaquotes) do not have a web-based version of the platform, meaning that traders can configure the platform according to their personal preferences, then access, given that similar hardware is available, an identical trading interface to the one at their main trading station.

Of course, don’t expect to see the same screen layout that you have on your quad monitor workstation on a mobile device or public computer, but if you just want to check in on your trades once in a while as you go about any other business or task

While MetaTrader is perfectly suited and adaptable for the needs of the discretionary trader, it is geared towards automated trading.

This is a major benefit for traders who don’t want or can’t be, glued to a computer monitor. MetaTrader has automated trading programs built in that can be easily edited to account for the variables of various currency pairs as well as varying degrees of price volatility.

It doesn’t require an excessive degree of computer tech savvy, either. Many users are attracted by the ease with which indicators can be customized or created. This is also true of the automated trading programs.

Another aspect traders find appealing is the large community of MetaTrader users. This large user base means that just about any scenario you can imagine has already been encountered by someone, so getting technical questions answered and issues addressed is fairly simply accomplished.

One potential flaw in the opinion of some traders is the lack of automated back testing, but this should not be taken to imply that system back testing is not possible, just that it must be done manually, which takes longer. Of course, there are those among the ranks of successful forex traders that express skepticism around the whole subject of the value of back testing, so feel free to draw your own conclusions here.

Some traders may also find, if moving from a broker’s proprietary platform to MetaTrader, that it takes some time to get used to. The analogy here would be to compare proprietary platforms to a typewriter and MetaTrader to a full-featured modern word processing software package.

Of course, trading on a new platform of any kind without first giving it a good shake down with a simulated/demo account is foolhardy at the least. Most brokers make MetaTrader and simulated demo accounts freely available for some period of time, in some cases for as long as there is an active account with them, so unfamiliarity with MetaTrader is not a valid objection.

Now, if anyone knows of broker that will overlook losing trades, please inform us posthaste.

MetaTrader 5 New Features

The latest version has all the great things that have made MT4 so popular and much credit should be given to the developers for not fixing something that wasn’t broken.

Improvements include greater ease of multiple account management. This benefits traders who, for example, like to day trade under certain market conditions but have a different account for swing trading or scalping purposes.

There are seven new indicators, more powerful Expert Advisors and bugs and other issues with the trading script from the previous version have been remedied.

MetaTrader, although it continues to be challenged by NinjaTrader and a few ptjers, continues to occupy the number one spot for number of users, for good reason. Its power, depth and flexibility has made it the standard by which all others are judged.

Either version will do everything you could ever want a trading platform to do, as well as many things you will never think of.

Consider making it a part of your traders toolbox, even if you should decide to not make it your primary trading platform.

How to Choose a Forex Trade Platform in Nigeria

For the beginning Forex trader choosing the right broker is essential. Basically a broker matches up a seller and a buyer for the trade. They charge a fee and sometimes a commission on the sale for this service. One can compare Forex brokers by asking questions and writing down the answers before beginning to trade. The trader should not be afraid to ask any question they may have out of embarrassment or the reaction of the broker. If a broker is rude or evasive with answers the trader should move on to another.

Important questions to ask are exactly how the broker charges and how they make trades. The broker’s answer will allow the trader to compare Forex brokers with each other fairly. The broker should be clear and concise with their answer. If the trader is unclear about the explanation a good broker will not hesitate to explain how and what they charge. The broker should explain clearly and simply how a forex trade works from beginning to end.

Ask if the broker uses a software program alone to determine the trades they will make for you. Software is nice but market research and experience will do better in the end. Write down all the answers you get from the broker. To truly compare Forex brokers ask several brokers and companies the same questions.

Another way to compare Forex brokers is by participating in forums that specialize in reviewing brokers or their companies. It will become clear very quickly to the trader which to hire and which to run from. Compare the posts- if a particular trader has lost money with different brokers then read posts about those brokers. If other traders have done well with them perhaps that trader is not making sensible trades.

There are honest brokers in the industry. The only way to find them is to compare Forex brokers by using the above methods. Perhaps someone the trader knows is familiar with a broker. If that person is satisfied with the resulting trades the search may be over. For others the search is just beginning. Forex trading should not be like gambling in Las Vegas- it should be treated with the same care one uses in the stock market.

The possibility of making a lot of money in a short time is enticing. No one run and jump into a swimming pool without making sure it was filled with water first. The same goes for Forex trading. The more research and education the trader has before going into their first trade the better their chances will be at making a profitable transaction. Of course there are no guarantees in the Forex market or even in the stock market. That is why only the bold choose to stay. There have been many that have made their fortunes.