Today, we’re going to dive into the world of forex trading and answer a question that’s been on the minds of many Nigerian traders: “Is LiteFinance legit in Nigeria?” So, buckle up, and let’s get started!

LiteFinance, formerly known as LiteForex, is a forex broker that was founded in 2005. It offers platforms available in MetaTrader 4 (MT4), MetaTrader 5 (MT5), and LiteFinance proprietary mobile apps. The broker is regulated by St. Vincent and the Grenadines and complies with all regulatory directives, including clients’ fund security.

Is Litefinance a Good Choice for Nigerians?

LiteFinance is a reputable choice for forex traders in Nigeria for several reasons:

- Educational Resources and Support: LiteFinance provides comprehensive educational resources catering to both beginner and experienced traders, ensuring a holistic trading experience. They also offer a demo account for traders to test their strategies without risking real money.

- Copy Trading: LiteFinance offers a feature where inexperienced traders can copy trades from successful traders, providing a learning opportunity and potential profits.

- Promotions and Competitions: LiteFinance regularly launches competitions and promotions for its clients, with prizes including money awards, cars, and cutting-edge gadgets.

- Local Representation: LiteFinance pays special attention to the growth of local representative offices and partnership relations, making trading conditions suitable for each client. They also have representatives in Nigeria to assist traders.

- ECN technology: LiteFinance is one of the best ECN brokers in Nigeria. The broker utilizes ECN (electronic communication network) technology, which provides direct access to global liquidity providers. This results in tight spreads, fast execution, and no requotes.

- Low minimum deposit: The minimum deposit to open a LiteFinance account is only $50 (42,359 Nigerian Naira). This makes forex trading accessible for Nigerian traders with smaller accounts.

- User-friendly trading platforms: The LiteFinance trading platforms are intuitive and easy to use. They include advanced charting, technical indicators, and copy trading options.

LiteFinance Safety and Regulation in Nigeria

While LiteFinance does not hold a financial license in Nigeria, it has a good reputation and has proven its reliability to traders.

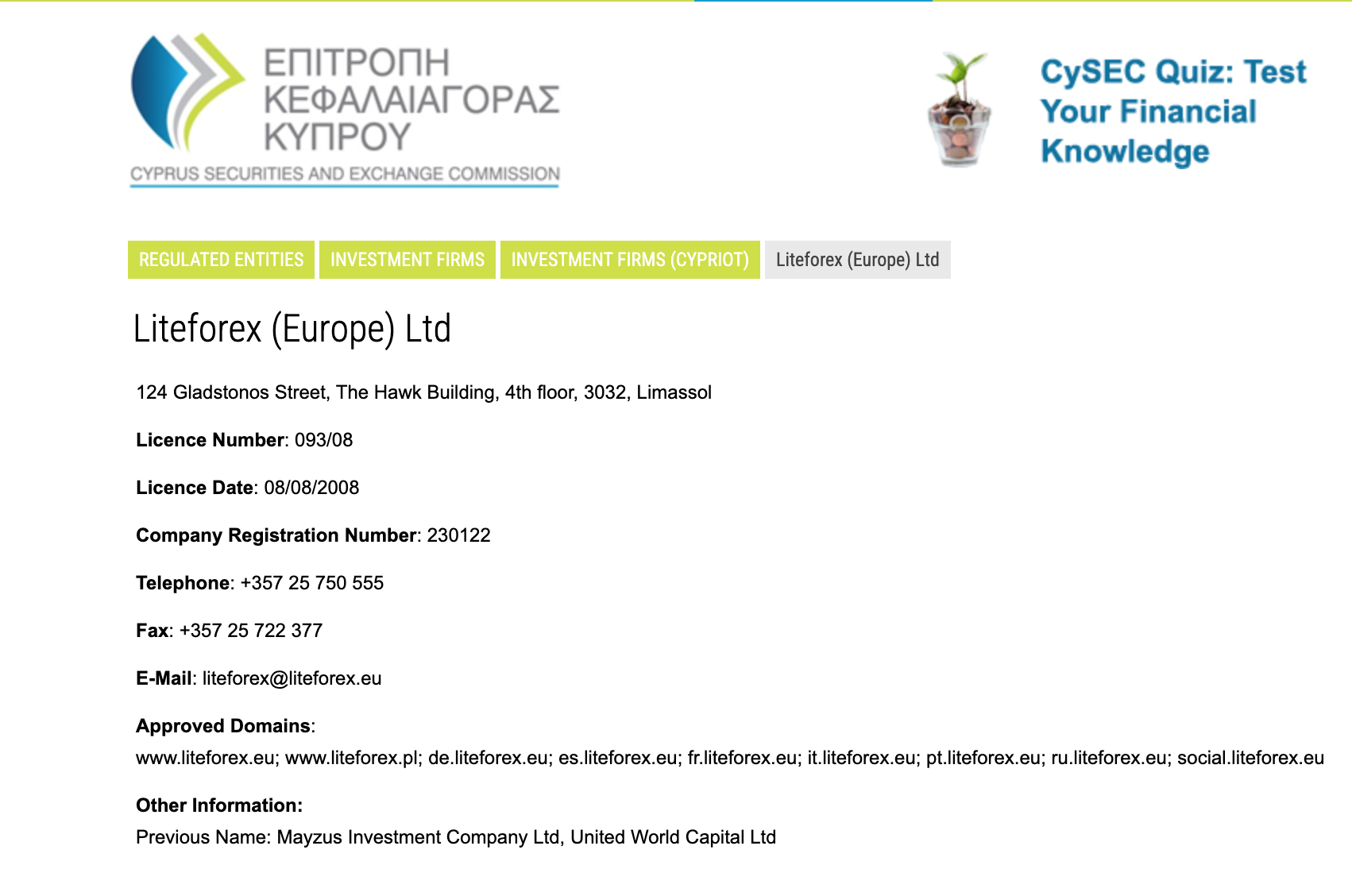

The forex broker is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 093/08. This regulation applies to brokerage services provided by Liteforex (Europe) LTD Company, which operates under the LiteFinance brand.

However, it’s important to note that while LiteForex Europe Limited is regulated by CySEC, a Tier 1 regulator, LiteFinance Global LLC is considered unregulated as it is overseen by the St. Vincent & the Grenadines Financial Services Authority (FSA).

This means that while clients of LiteForex Europe Limited enjoy certain protections such as negative balance protection and insurance by the Investor Compensation Fund (ICF) for up to €20,000, clients of LiteFinance Global LLC may not have the same level of protection.

The company has local offices located in various countries, including Kenya and Nigeria. Despite the lack of regulation for its global operations, LiteFinance has been praised for its customer support and trading platforms.

So, while LiteFinance is not locally regulated in Nigeria, it operates under the oversight of CySEC and has implemented robust safety measures to protect its clients. These include segregated accounts, which means that customer funds are kept separate from the company’s operational funds. This is a standard practice in the industry that ensures client funds are safe even if the company faces financial difficulties.

Additionally, LiteFinance has an Anti-Money Laundering (AML) and Know Your Customer (KYC) policy in place, which includes a sophisticated electronic system that verifies client identification records and tracks all transactions. This commitment to security can give you peace of mind when trading with LiteFinance.

Affiliate Program: LiteFinance offers a multi-level affiliate program, allowing you to earn a commission for attracting not only new traders but also new partners. All commissions are paid automatically as soon as a referral has conducted a trade

LiteFinance Trading Platforms

LiteFinance offers several trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader.

cTrader is an advanced trading platform with a user-friendly interface, advanced chart analysis tools, and unique options for algorithmic trading.

LiteFinance has integrated cTrader into its services, making it available for desktop, web, and mobile versions. The ECN account, LiteFinance’s most popular trading account, is compatible with cTrader.

For mobile trading, LiteFinance provides mobile apps for both Android and iOS devices. These apps offer a range of features, including access to trading instruments, interactive price charts, one-click trading, and copy trading through their social trading system.

The mobile apps also provide analytical support for various currency pairs, oil, and precious metals.

LiteFinance Account Types

LiteFinance offers a variety of account types to cater to the diverse needs of forex traders. These account types include the Standard Account, ECN Account, Islamic Account, and Cent Account. Each of these accounts has unique features and benefits that make them suitable for different types of traders.

Standard Account

The Standard Account, also known as the Classic Account, is designed for traders who have extensive experience in trading and have formed views on the market. This account type offers increased quoting precision, market execution, and no requotes. It also provides high leverage up to 1:1000, allowing access to large-volume transactions. The minimum deposit for this account is $50.

ECN Account

The ECN Account is ideal for professional experienced traders as well as investors and traders. This account type offers increased quoting precision, market execution, and no requotes. It also allows scalping and news trading, and trades are delivered directly to liquidity providers, eliminating any conflict of interest. The ECN Account also offers a 2.5% per annum in your account and leverage up to 1:1000.

Islamic Account

The LiteFinance Islamic Account, also known as the Swap-Free account, is designed for traders who wish to adhere to the principles of their religion. This account type does not involve swaps for carrying positions over to the next day. Instead, traders only pay commissions and fees that do not contradict the Sharia principles. The Islamic Account provides the same benefits as other LiteFinance trading accounts, including access to financial markets and Tier-1 liquidity without swaps.

Cent Account

The LiteFinance Cent Account is ideal for traders who are just starting their trading career at LiteFinance. This account type offers the opportunity to trade in micro lots, with the size of the contract being only $1,000. The minimum deposit for this account is $10, making it accessible for traders who do not wish to make huge deposits at the beginning of their trading journey.

LiteFinance Customer Support in Nigeria

LiteFinance offers a comprehensive and robust customer support system for forex traders in Nigeria.

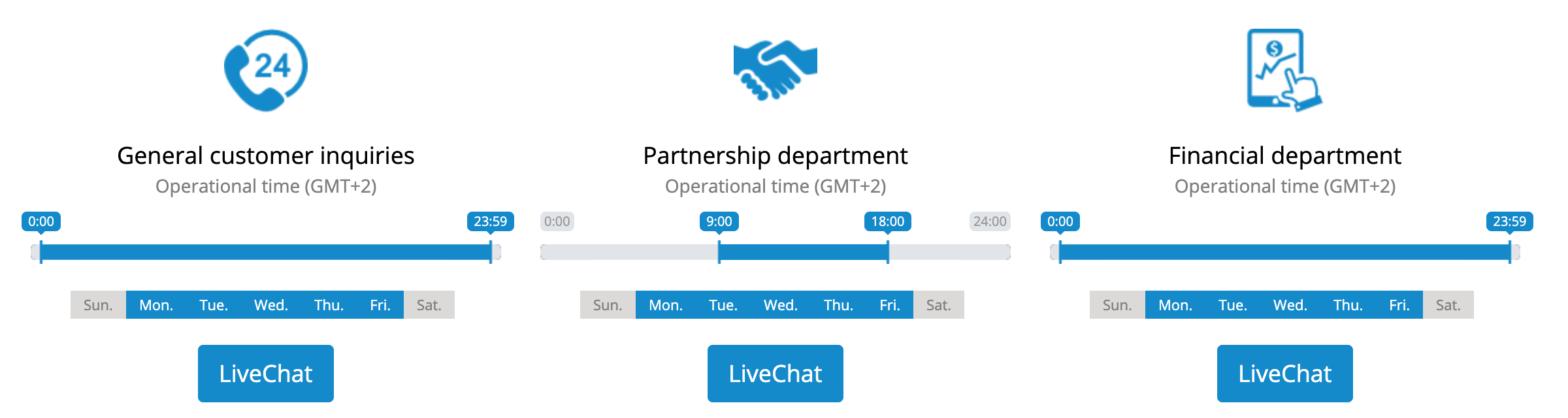

The company provides a 24/5 customer support service, operating from 00:00 Monday to 23:59 Friday (GMT+2). This ensures that traders can get assistance at almost any time during the trading week.

The company offers multiple channels for communication, including email, Skype, and Telegram. This variety of contact methods allows traders to choose the most convenient way to reach out to the support team.

Additionally, LiteFinance also provides a live chat feature, which is often the most convenient way to get quick responses to queries.

LiteFinance also offers local support in Nigeria, with specific contact details including phone, email, and WhatsApp. This local presence can be particularly beneficial for Nigerian traders, as it allows for more personalized and culturally sensitive support.

In addition to these support channels, LiteFinance has a comprehensive FAQ section on their website. This section covers a wide range of topics, from account setup and verification to deposits and withdrawals. This resource can be very useful for traders to find quick answers to common questions.

LiteFinance Trading Conditions

LiteFinance offers advantageous trading conditions. They provide raw spreads from 0 points, the best liquidity providers, and ECN technologies. They also offer over 170 assets to trade, including currencies, precious metals, commodities, cryptocurrencies, indexes, and stocks. Fast deposits and withdrawals, one-click trading, over 75 indicators, and other technical analysis tools are built into the platform. They also offer swap-free accounts and a traders’ ranking system for copy trading.

LiteFinance provides a wide range of payment methods for deposits and withdrawals, including international e-payment systems, bank cards, wire transfers, and other trusted methods. For Nigerian traders, LiteFinance also supports local deposits and offers a variety of deposit currencies including USD, EUR, MBT, KES, TZS, and NGN.

To deposit funds into your LiteFinance account, you need to log into your account, select the option for deposits, and follow the instructions to make a deposit. Make sure to select the correct deposit currency if there is a choice available. Then, select the LiteFinance deposit option, choose your payment method, and fill out the required payment information.

What Can You Trade on LiteFinance?

LiteFinance offers a wide range of trading assets and instruments that cater to various trading preferences and strategies. These assets are grouped into five main categories: Forex, Stocks, Indices, Commodities, and Cryptocurrencies

Forex

Forex trading is a major focus for LiteFinance in Nigeria. The platform offers trading in major, minor, and exotic currency pairs. This includes all the most popular pairs like EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD and USD/CAD. When trading currency pairs, you speculate on the price movement between two currencies. You can profit whether the exchange rates rise or fall.

The key benefits of trading currencies on LiteFinance include:

- High liquidity and fast execution

- Market open 24 hours a day, 5 days a week

- Leverage allows controlling large positions

- Tight spreads from 0.4 pips on ECN accounts

Indices

LiteFinance provides CFDs on major global stock indices like S&P 500, FTSE 100, DAX 30, Nikkei 225, ASX 200, and more. Trading index CFDs gives exposure to entire markets in one trade. You can profit from both rising and falling indices. Benefits include:

- Reflects the health of economies/sectors

- Lower costs than trading many stocks

- Continuous price fluctuations

- Useful for hedging strategies

Spreads start from 1 pip and leverage up to 1:100 is available.

Stocks

LiteFinance offers CFDs on over 100 popular stocks from major companies around the world. You can trade CFDs on stocks like Apple, Amazon, Google, Facebook, Tesla, Alibaba and more. Key benefits:

- Access to global stocks from one platform

- Go long or short to profit from rising and falling prices

- No expiry dates like options

- Leverage for bigger profits

- Lower costs than buying the actual stocks

Stock CFDs have spreads from 0.1 pips. Leverage up to 1:5 can be used.

Commodities

LiteFinance provides CFDs on commodities like gold, silver, oil, natural gas, and softs like coffee, corn, and wheat. Trading commodity CFDs gives exposure to price movements without owning the physical commodity. Benefits include:

- Hedge against inflation

- Diversify your portfolio

- Profit from rising and falling prices

- Useful for hedging strategies

- Leverage for bigger profits

Average spreads are around 20 pips on commodities. Leverage up to 1:100 is available.

Cryptocurrencies

LiteFinance offers CFDs on over 100 popular cryptocurrencies including Bitcoin, Ethereum, Litecoin, Ripple, Cardano, and more. You speculate on crypto prices without needing to own the coins. You can profit whether prices rise or fall. Benefits:

- Exposure to crypto volatility

- Go long or short

- No need to store coins yourself

- Market open 24/7

- Leverage magnifies profits

Crypto CFDs have average spreads of 200 pips. Leverage up to 1:5 is available.