Online trading has seen massive growth in Nigeria in recent years. With an expanding economy and young population, more Nigerians seek investment opportunities and trade in financial markets.

This rising interest has attracted many international forex brokers to offer their services to Nigerian traders. One such broker that has made inroads into the Nigerian market is Exness.

Exness Overview

Founded in 2008, Exness has established itself as a leading global broker with a strong presence across Africa. The company prides itself on strong values of transparency and honesty, which has helped it earn the trust of traders around the world. Fast forward to today, and Exness is making its mark in Nigeria, providing traders with a platform that’s designed to meet their trading needs and aspirations.

Exness accepts clients from Nigeria and has customized its offering to provide an optimal trading experience for the Nigerian market. Nigerian Naira is available as a base currency and local payment methods like bank transfers are supported for deposits and withdrawals.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

With competitive spreads starting from 0.1 pips and fast execution speeds, Exness aims to provide the best trading conditions for Nigerians. Its multiple trading platforms like MetaTrader 4, MetaTrader 5, and Exness Trade web platform cater to different trading needs.

-

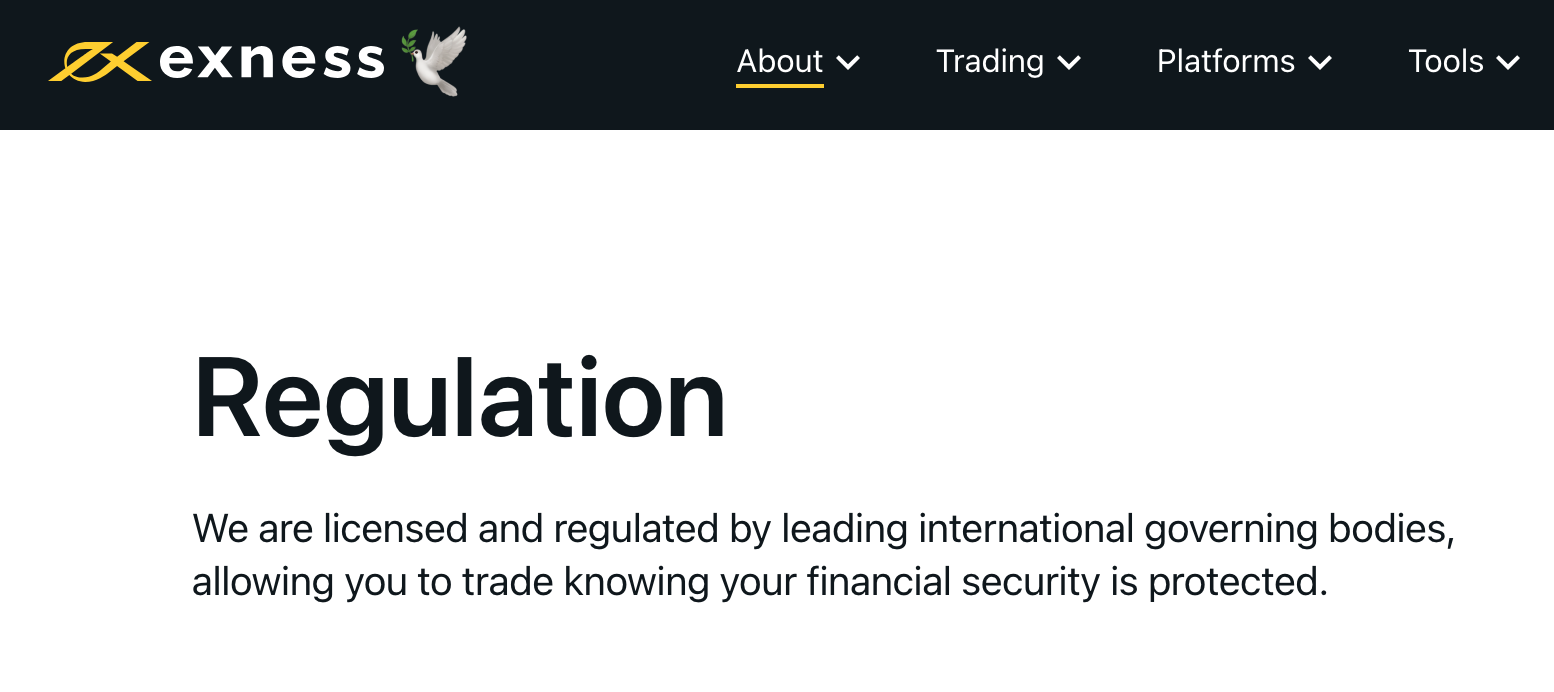

Exness Safety & Regulation in Nigeria

One of the first questions you should ask about any Forex broker is, “Are they legit?” With Exness, the answer is a resounding “Yes.” They’re regulated by several international financial authorities, which means they have to stick to strict rules and keep your money safe. In Nigeria, they operate with full compliance, ensuring you can trade with peace of mind.

✅ Exness is regulated by top-tier authorities like the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC) which reassures Nigerian traders about Exness’ safety and compliance standards.

-

Exness's Presence in Nigeria

Exness hasn’t just waltzed into Nigeria without thought. They’ve tailored their services for the Nigerian market. That means local customer support, Naira-based accounts, and banking options that work seamlessly for you. They understand the Nigerian economic climate and have positioned their services to be as friendly and convenient for Nigerian traders as possible.

☑️ Exness allows Nigerian clients to access a diverse range of over 200 trading instruments from currencies, cryptocurrencies, global stocks, commodities and indices. This variety enables traders to diversify their portfolios.

-

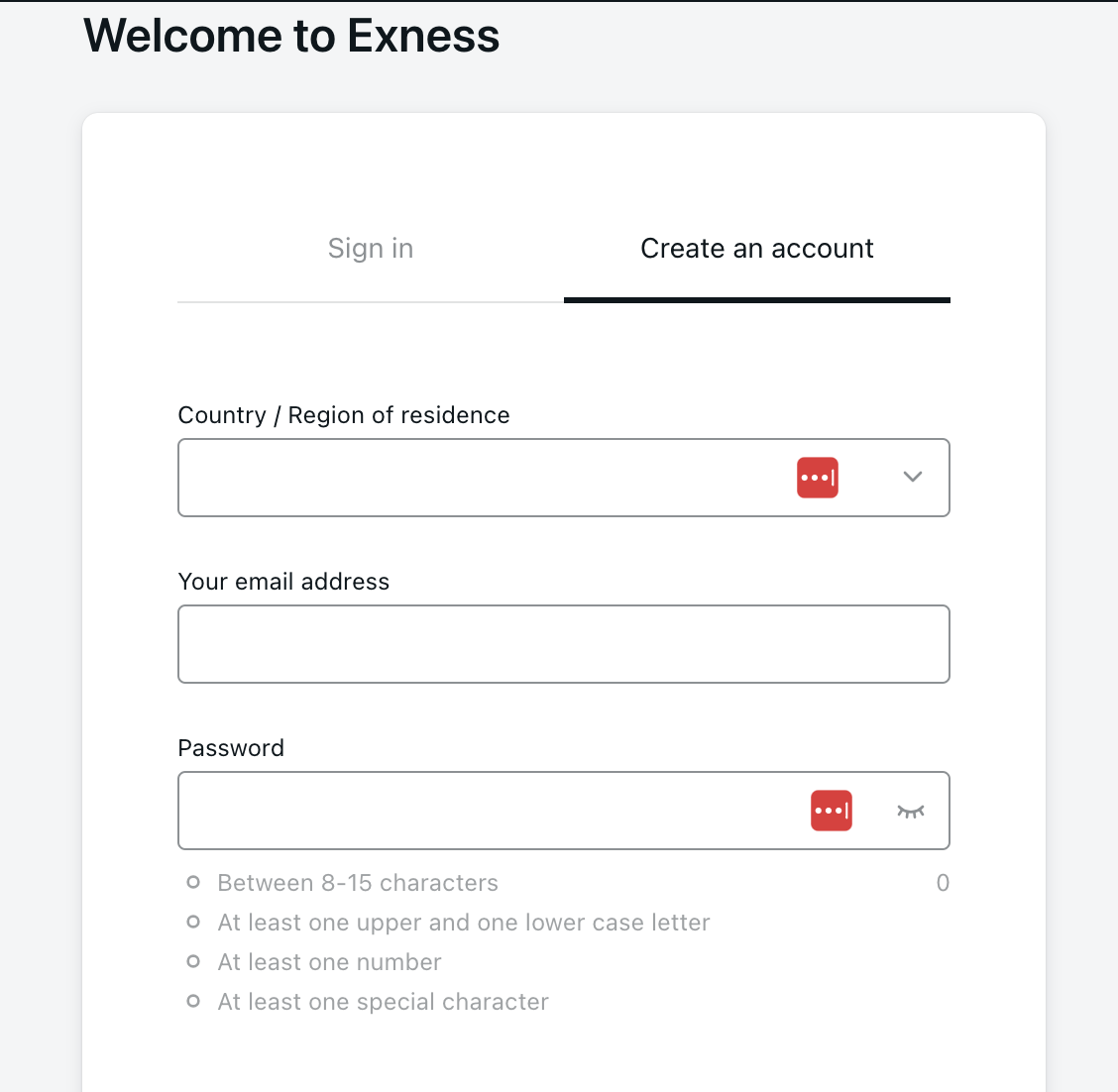

Exness Account Registration and Verification Process

Alright, let’s get down to business – the first step to trading with Exness in Nigeria. If you’re ready to jump into online Forex trading, you’ve got to start with setting up your account. Don’t worry; it’s not as daunting as it sounds. Here’s a step-by-step breakdown of how to get your trading career rolling with Exness.

Step-by-Step Account Opening Process

- Visit the official Exness website and click on that yellow 'Register' button.

- Fill in your details. We're talking name, email, and phone number etc

- Choose the type of account that fits your trading style. Not sure which one to pick? Exness breaks them down so you can make an informed choice.

- Set your trading leverage. If you're new to this, leverage is basically your way of controlling big dollar amounts with just a small investment.

- Download your trading platform of choice. Whether you're a fan of MetaTrader 4, MetaTrader 5, or the Exness Trader app, get it on your device and get familiar with your new trading platform.

-

Documents Needed for Exness Account Verification

Here are the key documents required for Exness account verification:

- Proof of Identity: Passport, National ID card, Driver’s License

- Proof of Address: Utility bill, Bank statement, Tax bill

Nobody likes paperwork, but in the Forex world, it’s all about keeping things above board. So, once you’ve filled in your details, Exness will need some ID from you. We’re talking about a valid ID card, your passport, or a driver’s license – and yeah, they need to be in date. A recent utility bill or bank statement will sort out the proof of residence part. Just snap some clear pics of these documents and upload them to your account. Easy!

Once you’ve sent in your docs, Exness will take it from there. Their verification process is pretty quick (usually within 24 hours), so you won’t be left hanging for long. You’ll get an email or an SMS once everything’s checked out, and boom – you’re in. Now you’re ready to deposit some funds and get the ball rolling.

-

Exness Minimum Deposit in Nigeria

The minimum deposit is the smallest amount of money that you are required to fund your trading account with. It’s like the entry ticket to the trading world. For Exness, the minimum deposit in Nigeria is quite accessible.

You can start trading with as little as $10, which is about 4,150 Naira at the current exchange rate. This low entry barrier makes Exness an attractive option for both beginners and experienced traders who are looking to test the waters without committing a large sum of money.

Several other forex brokers also offer low or no minimum deposit requirements. For instance, CMC Markets and Pepperstone allow traders to open accounts with $0 minimum deposits. Forex brokers with low minimum deposits are very suitable for beginners who may not want to risk a large amount of capital at the outset.

Exness Account Types and Their Minimum Deposits in Naira

Exness offers several account types, each with its own set of features and minimum deposit requirements:

- Standard Account: The most basic account type, which is great for beginners, requires a minimum deposit of just $10.

- Pro Account: Designed for more experienced traders, this account has a higher minimum deposit of $200.

- Raw Spread and Zero Accounts: These accounts cater to high-volume traders and also require a minimum deposit of $200.

You should choose the account type that aligns with your trading style and financial capacity.

Deposit Methods Available in Nigeria

Exness provides a variety of deposit methods to accommodate Nigerian traders, including:

- Bank Wire Transfer: You can transfer funds directly from your Nigerian bank account to your Exness trading account.

- Electronic Payment Systems: Options like Neteller and Skrill are available for instant and secure transactions.

- Mobile Payment Methods: Convenient for traders who prefer to use their mobile devices for financial transactions.

- Cryptocurrencies: For those who prefer digital currencies, Bitcoin is an option.

As you can see, Exness has also made it super simple for traders in Nigeria to deposit and withdraw profits with options like bank transfers, credit cards, and even mobile payments. Pick your preferred method and follow the prompts to deposit your trading capital. Don’t stress; it’s all secure and straightforward.

Tips for a Smooth Deposit Experience

To ensure a seamless deposit process, consider the following:

- Verify Your Account: Complete the account verification process in advance to avoid any delays.

- Understand the Fees: While Exness does not charge deposit fees for traders in Nigeria, be aware of any fees that may be applied by your payment provider.

- Secure Your Details: Keep your login and payment information secure at all times.

- Currency Alignment: Make sure your deposit currency matches your trading account’s base currency to avoid conversion fees

Also Read: Best Forex Brokers That Accept Mobile Payments

Just like that, you’re all set with Exness in Nigeria. With a funded account and the verification out of the way, you’re primed to start trading. Exness has made sure that getting to the starting line is as hassle-free as possible, leaving you to focus on what really matters – making those savvy trading moves.

With just a few clicks, some quick paperwork, and a deposit,

your Exness account will be ready for action.

Visit the official Exness Website to Open Your Account Now.

-

Exness Trading Platforms and Tools

Now that you’ve got your Exness account locked and loaded, it’s time to talk about the nuts and bolts of your trading experience with Exness in Nigeria – the trading platforms and tools. After all, your platform is your gateway to the markets, and the tools are what help you find your way through the trading jungle.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

✅ With Exness, you’re spoiled for choice when it comes to trading platforms. You’ve got MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular platforms in the Forex universe.

📱 And then there’s the Exness Trader app – for trading on the go. Because let’s face it, you’re not always going to be at your desk when you need to make that crucial trade. This app puts the power of the trading floor in your pocket.

🌐 Exness also provides a WebTerminal trading platform. The WebTerminal is the broker’s proprietary web-based trading platform that provides a simple yet powerful trading experience. The Exness WebTerminal allows traders to access markets and trade from anywhere without installing any software.

And when it comes to trading tools, Exness doesn’t skimp. Technical analysis? Check. Economic calendars? You bet. Real-time news updates? Absolutely. Everything you need to make informed decisions is at your fingertips.

The best part? These tools are integrated right into your trading platform. This means you can analyze trends, check out what’s shaking the markets right now, and plan your next move without ever leaving the platform. It’s like having a trading command center that operates at the speed of the market.

-

Exness Deposit and Withdrawal Options for Nigerian Traders

Let’s face it, the ease of moving your money in and out of your trading account can be the make-or-break factor in your trading journey. You want the process to be like a smooth dance, not a wrestling match. So, how does Exness in Nigeria fare when it’s time to fund your trades or withdraw your profits

- Exness accepts deposits in both USD and NGN (Nigerian Naira) to accommodate local traders.

- Minimum deposit is $10 or equivalent in NGN. No deposit fees charged by Exness.

- Withdrawals can be made in NGN to Nigerian bank accounts, allowing easy access to funds.

- Exness supports local payment methods like bank transfers and debit cards that are popular in Nigeria.

- Withdrawals are processed instantly with selected methods or within 1 business day for bank transfers.

- Traders can start trading immediately after making the deposit as account verification is not required for deposits.

✅ No deposit or withdrawal fees are charged by Exness. However, banks and other payment methods may impose transaction charges.

✅ The minimum deposit on Exness is $10 (around 4,500 NGN). While the maximum deposit ranges from $9,500 to $45,000 depending on the bank.

-

Exness Customer Support Review

Exness understands the importance of prompt and efficient customer support in forex trading. To ensure Nigerian traders have access to assistance whenever required, Exness provides:

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

Multiple Contact Channels

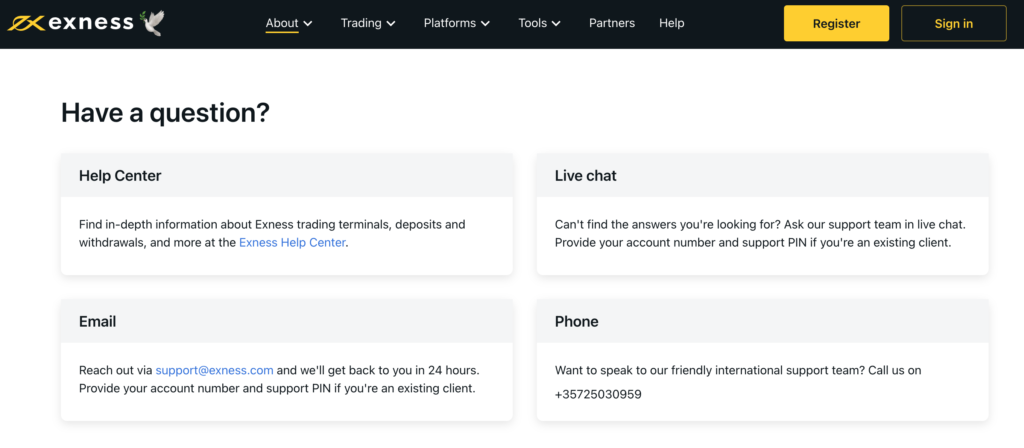

Whether you prefer to shoot an email, make a phone call, or get instant feedback via live chat, they’ve got you covered. Exness offers various communication channels for customer support including:

- Live Chat – Get immediate assistance with pressing issues through live chat.

- Email – Send non-urgent inquiries via email to [email protected].

- Phone – Speak to a support representative directly by phone.

24/7 Availability

Exness provides round-the-clock customer support 24/7. Traders can reach out for assistance at any time, even outside regular business hours.

The coolest thing about Exness’s customer support is the blend of international expertise with a local understanding. They offer support in multiple languages, which is great, but for Nigerian traders, sometimes you just want someone who gets where you’re coming from – both geographically and culturally. Exness steps up here, providing personalized assistance that feels closer to home.

-

Key Areas of Exness Customer Support

Exness customer support helps Nigerian traders resolve issues related to:

- Account Management: You can get assistance with account opening, verification, login issues, changing account settings, and more.

- Deposits and Withdrawals: Exness support helps with processing deposits and withdrawals, transaction errors, and resending withdrawal requests.

- Trading Platform Issues: Traders can get support regarding platform errors, assistance with orders, and help with MT4/MT5 trading platforms.

- Technical Issues: If you're experiencing errors, system crashes or platform bugs, Exness tech support helps troubleshoot and resolve technical glitches.

With just a few clicks, some quick paperwork, and a deposit,

your Exness account will be ready for action.

Visit the official Exness Website to Open Your Account Now.

-

Exness Trading Fees Spreads, Margins, and More

The costs for trading on Exness include variable spreads and, for some accounts, commissions per lot traded. Spreads start from 0 pips on EUR/USD for Raw Spread and Zero accounts.

On Standard accounts, spreads start from 0.3 pips on EUR/USD with no commission fees. For active traders, Raw Spread accounts offer ultra-tight spreads with a commission of up to $3.50 per lot.

Exness does not charge deposit, withdrawal, or account inactivity fees. Swap rates apply for holding positions overnight.

Certain Exness accounts involve commissions in addition to spreads:

- Raw Spread Account - Up to $3.50 commission fee per lot traded

- Zero Account - Fixed $2 commission per lot on spread-free instruments

Exness Margins and Leverage

Exness offers high leverage up to 1:Unlimited, allowing Nigerian traders to open larger positions with less capital.

The margin requirements vary based on the trading instrument. For major currency pairs, the margin is 0.25% of the position size when using maximum leverage.

For example, to open a $100,000 EUR/USD position with 1:400 leverage, a trader would need to have $250 in their account as margin.

Exness has automatic margin call and stop-out levels set at 30% and 0% respectively for all account types. This protects traders from accumulating negative balances.

Some key points about using Exness as a Nigerian trader:

- Exness offers competitive trading conditions including tight spreads from 0 pips, fast execution speeds, and high leverage up to 1:2000. This makes it suitable for active trading styles like scalping.

- Nigerian traders can open accounts with minimum deposits as low as $1 (for Cent accounts) or $5 (for Standard accounts). More advanced accounts have higher minimums starting from $500.

- Exness provides access to over 200 trading instruments across forex, commodities, global stocks, indices, energies, and cryptocurrencies. This allows Nigerian traders to diversify their portfolios.

- Popular trading platforms like MetaTrader 4, MetaTrader 5, and the Exness Trader app are available. This gives traders flexibility to choose their preferred platform.

- Exness supports several deposit and withdrawal options relevant for Nigerian traders including bank wire transfers and local e-wallets like Perfect Money, Bitcoin, Neteller, and Skrill.

- Multilingual 24/5 customer support is available through live chat, email, and phone. However, there is no local office or support number in Nigeria.

- Exness offers an affiliate program that Nigerian traders can join to earn commissions for referring new clients.

Exness Review FAQ

Yes. Exness is one of the best forex brokers for Nigerian traders. Exness is regulated by several top-tier regulatory bodies including the FSCA, CySEC, FCA, and FSA, which provides a sense of trust and security for Nigerian traders.

Additionally, Exness supports the Nigerian Naira (NGN) as a base account currency and allows free deposits/withdrawals in NGN.

Yes, Nigerians can open trading accounts and use Exness as their broker for forex, CFD, and crypto trading. Exness accepts clients from over 130 countries, including Nigeria.While Exness does not have an entity regulated by Nigerian authorities, it is regulated in multiple reputable jurisdictions like the UK, Cyprus, Seychelles, and South Africa. Exness operates in Nigeria through its Seychelles entity called Exness (SC) Ltd which is regulated by the Financial Services Authority (FSA) of Seychelles under license number SD025.