In the dynamic world of forex trading, choosing the right broker can make all the difference between success and failure. Today, we turn our spotlight on a forex broker that has been making waves in the industry, particularly in Nigeria – JustMarkets.

JustMarkets, a name that has been gaining traction among forex traders in Nigeria, promises a blend of competitive spreads, innovative trading platforms, and robust customer support. But does it live up to the hype? That’s what we’re here to find out.

In this comprehensive JustMarkets review, we aim to provide you with an in-depth understanding of JustMarkets, helping you make an informed decision about whether this broker is the right fit for your trading needs, especially if you reside in Nigeria.

JustMarkets Safety, Trust and Regulation

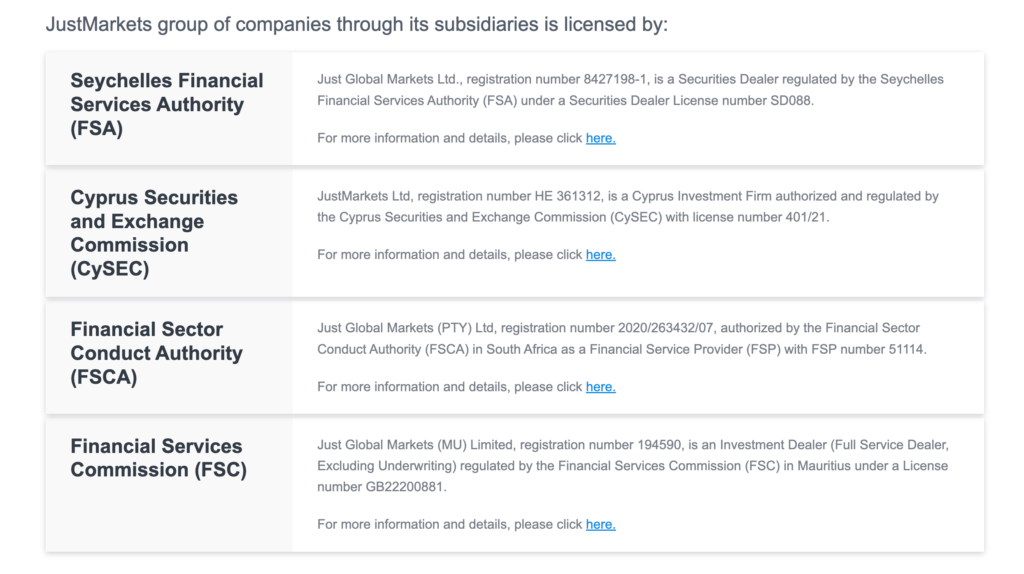

JustMarkets is regulated and licensed by multiple authorities, which ensures a transparent and secure environment for forex traders in Nigeria. The company’s regulatory oversight includes:

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

- Cyprus Securities and Exchange Commission (CySEC): JustMarkets Ltd, with registration number HE 361312, is authorized and regulated by CySEC under license number 401/21. CySEC is considered a Tier-1 regulator, providing a high level of protection for traders.

- Seychelles Financial Services Authority (FSA): Just Global Markets Ltd, with registration number 8427198-1, is regulated by the FSA under a Securities Dealer License number SD088. FSA is a Tier-3 regulator, offering a lower level of protection compared to Tier-1 regulators.

- Financial Sector Conduct Authority (FSCA) in South Africa: Just Global Markets (PTY) Ltd, with registration number 2020/263432/07, is authorized by the FSCA as a Financial Service Provider (FSP) with FSP number 51114.

- Financial Services Commission (FSC) in Mauritius: Just Global Markets (MU) Limited is authorized and regulated by the Mauritius Financial Services Commission with the registration number 194590.

These regulatory bodies provide a secure environment for forex traders in Nigeria, ensuring that JustMarkets adheres to strict guidelines and maintains transparency in its operations.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

In Nigeria, forex brokers are required to have an office in the country as a mandatory condition for obtaining a license.

However, it is also possible for a broker to operate in Nigeria without a local license, provided they have a license from a reliable international regulator. This is the case with JustMarkets, which operates in compliance with the financial rules and regulations of its international regulatory authorities.

JustMarkets Overview

JustMarkets is a popular forex broker among Nigerian traders, known for its reliability, adaptability, and effectiveness.

Founded in 2012 and based in St. Vincent and the Grenadines, JustMarkets has carved a niche for itself in the Nigerian forex market, despite not having a physical office in the country.

JustMarkets Trading Platforms

JustMarkets offers access to the renowned MetaTrader 4 and MetaTrader 5 platforms. These platforms are known for their user-friendly interfaces, advanced charting capabilities, and a wide range of technical indicators. They also support automated trading through Expert Advisors (EAs), allowing traders to automate their strategies and take advantage of market opportunities 24/7.

JustMarkets Account Types

JustMarkets offers several account types to cater to the diverse needs of traders. These include retail investor accounts and Islamic accounts, which are compliant with Sharia law. The broker also provides a demo account for beginners to practice their trading strategies without risking real money.

JustMarkets Trading Fees and Commissions

One of the main attractions of JustMarkets is its low trading fees. The broker offers competitive spreads and does not charge commissions on deposits and withdrawals. This makes it an attractive choice for traders looking to maximize their profits. However, traders should be aware of the potential risks and ensure they understand their risk tolerance before investing.

JustMarkets Regulation and Safety

While JustMarkets is not regulated by the Central Bank of Nigeria (CBN), it has a high trust score among Nigerian traders. The broker obtains liquidity from 18 of the world’s largest banks, ensuring the best possible pricing for its clients. All client funds are kept in segregated accounts, separate from JustMarkets’ own funds, providing an additional layer of security.

JustMarkets Customer Support

JustMarkets prides itself on its fast and efficient customer support team. The team is available online to assist traders with any issues or queries they may have. This high level of customer service has contributed to JustMarkets’ high trust score among Nigerian traders.

Join the Copy Trading Revolution

Copy the trades of successful Forex traders and profit from their strategies.

*Forex and CFDs Trading involves high risk. T&Cs apply.

JustMarkets Deposit and Withdrawal Methods

JustMarkets offers a variety of deposit and withdrawal methods, making it easy for Nigerian traders to fund their accounts and withdraw their profits. However, the specific methods available may vary, so traders are advised to check the broker’s website for the most up-to-date information.

In conclusion, JustMarkets is a reliable and trusted forex broker in Nigeria, offering a range of services to meet the needs of different traders. However, as with any investment, trading forex involves risks, and traders should ensure they understand these risks before investing.

JustMarkets Trading Fees and Commissions

JustMarkets offers attractive trading fees, with spreads for their Pro Account often lower than the industry average. The Standard and Standard Cent accounts have spreads starting from 0.3 pips, while the Pro account offers spreads from 0.1 pips.

In terms of commissions, trading with JustMarkets is generally commission-free, except for the Raw Spreads account holders. The commission for the Raw Spread account is 3 units of the base currency per lot per side. This means that for every lot traded, a commission of 3 units of the currency you are trading is charged on both the opening and closing of the trade.

Additional Fees

- JustMarkets does not charge inactivity fees. However, if the time of inactivity on the account exceeds 90 days, the broker may move to archive client trading accounts. Also, the account may be moved to the archive if the balance is less than $1

- JustMarkets provides a high number of deposit and withdrawal options and doesn’t charge fees for that. Some withdrawal methods are processed instantly. However, traders should note that withdrawals to debit/credit cards may take up to 10 bank days

While JustMarkets offers commission-free trading on certain accounts, it’s important to note that there are other fees that may apply. For instance, deposit fees are charged on all deposits made in cryptocurrency, with a 1% commission. However, there are no fees for deposits and withdrawals except for deposits via crypto which will incur a blockchain fee.

Justmarkets Education and Research

JustMarkets provides a high number of educational articles and online webinars. However, it received a below-average score in the Education category due to the absence of trading courses or educational videos.

For Nigerian traders, it’s crucial to continuously refine your skills and strategies for success. Prioritize risk management, stay updated with market news, and leverage the tools and technology provided by your trading platform.